March 2: The most important deadline for Cal Grants is March 2.

Be sure you submit your FAFSA and your verified Cal Grant GPA by the March 2 Cal Grant application deadline.

Keep in mind that your college may have earlier deadlines for its financial aid programs, so be sure to check with each college you’re considering.

Also, deadlines for private scholarships may be earlier in the year.

Weekly digest of information and resources for college applications, education success and financial aid.

Follow the included links to find articles to learn more.

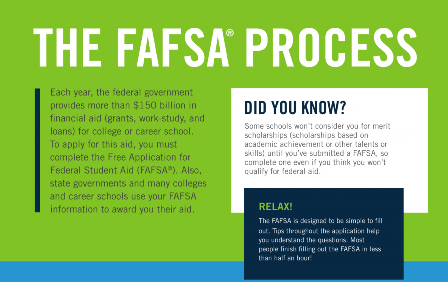

If you have not yet completed your FAFSA,

make this a required task this week.

File your FAFSA.

Go to www.fafsa.ed.gov

Review how to fill out the FAFSA – click here.

Tip Tuesday

Reduce Your Risk When Applying for Aid

- Fill out the FAFSA form at fafsa.gov.

- After completing the FAFSA, exit the application and close the browser

- Don’t tell anyone your FSA ID, even if that person is helping you fill out the FAFSA form.

- Review your financial aid award documents and keep track of the amounts you applied for and received.

- Never give personal information over the phone or internet unless you made the contact.

- Before providing personal information to an organization, review its privacy policy.

Visit studentaid.ed.gov to learn more ways to safely file your FAFSA.

QUESTION:

What are “grants” and “loans”?

ANSWER:

These are both types of funding you can be offered through financial aid.

Grant: A form of financial aid that you do not have to repay. Also called Gift Aid.

Loan: A form of financial aid that you must repay, usually repayment includes interest charges and fees.

Interest

A loan expense. Interest is money paid to the lender in exchange for borrowing money. The expense is calculated as a percentage of the unpaid principal amount of the loan.

MYTH: Loans for college are all the same.

FACT: All loans require that you pay the money back with interest, however there are different types of loans for college students and some are more beneficial to students. In short, Direct Subsidized Loans from the federal government have slightly better terms to help out students with financial need. Be sure you understand your loan options and responsibilities. Learn more about types of loans here.

Federal student loans inc lude many benefits not typically offered with private loans – learn more.

“Once I received this scholarship, the momentum to achieve my goal became realistic. Future Sacramento gives me countless opportunities that make getting to college possible. Their belief in me is motivating. Now it is up to me to make sure I utilize everything they have given me.” – Luciano