March 2: The most important deadline for Cal Grants is March 2.

Weekly digest of information and resources for college applications, education success and financial aid.

Follow the included links to find articles to learn more.

Do NOT wait until your taxes are filed – the FAFSA wants you to enter tax information from last year’s return, referred to as “prior-prior year.” The 2018–19 FAFSA form asks for 2016 tax information.

If you have not yet completed your FAFSA,

finish it today. Go to www.fafsa.ed.gov

Tip Tuesday

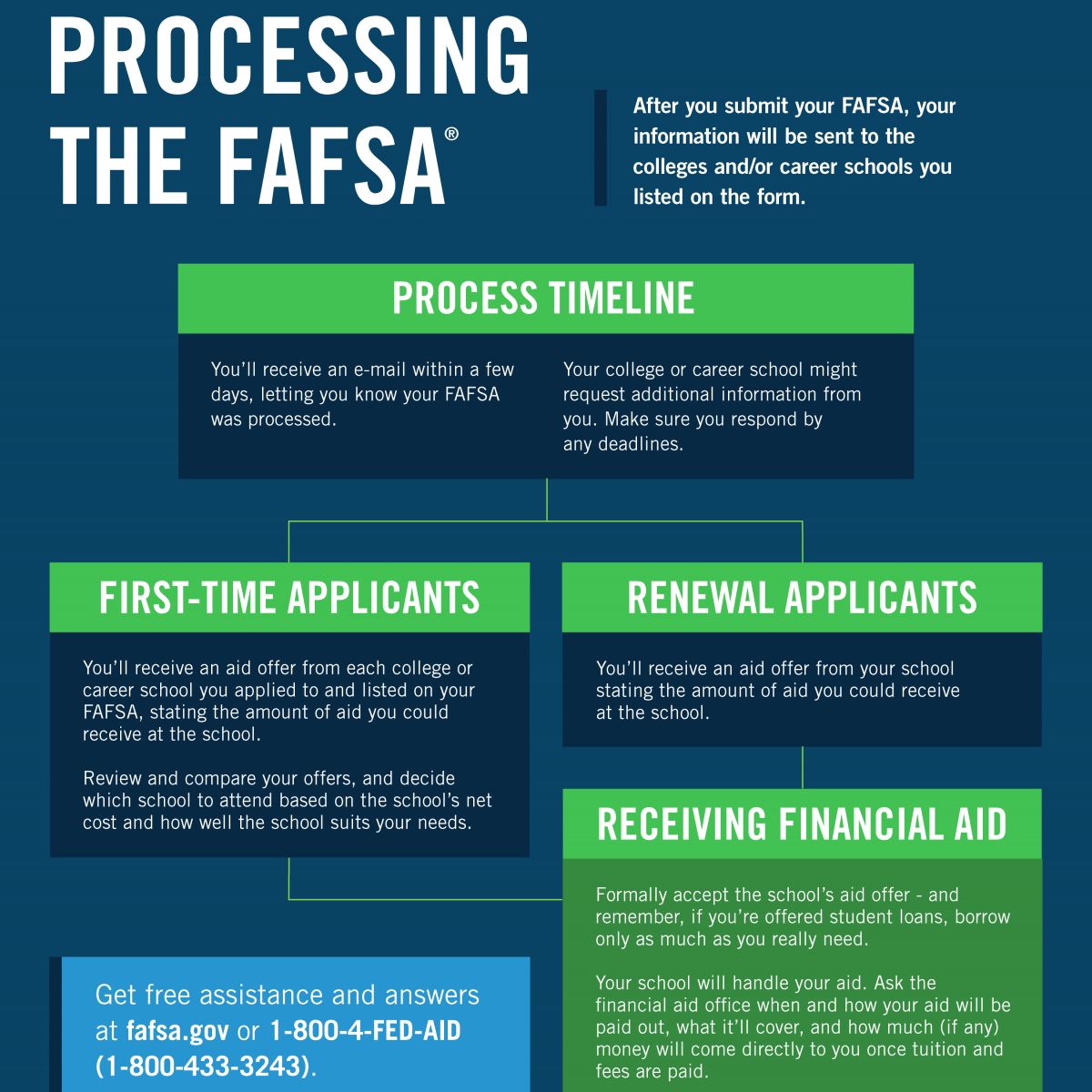

Here are some tips for immediate next steps after you finish the FAFSA:

- You can check to see whether 0r not your FAFSA form has been processed immediately after submitting it online.

- The FAFSA results in a Student Aid Report (SAR), you should receive it within three days to three weeks after you submit your FAFSA form.

- Check your Student Aid Report (SAR) for accuracy. If you don’t have any changes to make to the information listed on your SAR, keep it for your records.

- If you review your SAR and find a mistake, you will need to correct or update your FAFSA form. Learn how.

- The school(s) you list on your FAFSA form will have access to your SAR data electronically within a day after it is processed. A school may ask you to verify the accuracy of your FAFSA data – so pay attention to any and all messages that you receive from colleges to which you applied.

QUESTION: What is the “Student Aid Report (SAR)”?

ANSWER:

A paper or electronic document that gives you some basic information about your eligibility for federal student aid and lists your answers to the questions on your Free Application for Federal Student Aid (FAFSA). The school(s) you listed on your FAFSA form will use your information to determine your eligibility for financial aid; therefore the accuracy of your FAFSA data is very important.

The SAR won’t tell you how much financial aid you’ll get, and it won’t show the details of the income and tax information if you used the Internal Revenue Service Data Retrieval Tool when you completed your FAFSA form.

Verification

The review process in which the financial aid officer requests documentation from a financial aid applicant to verify the accuracy of the application. This is the process your school uses to confirm that the data reported on your FAFSA form is accurate. Your school has the authority to contact you for documentation that supports income and other information that you reported. If you’re selected for verification, don’t assume you’re being accused of doing anything wrong. Some people are selected at random; and some schools verify all students’ FAFSA forms. All you need to do is provide the documentation your school asks for—and be sure to do so by the school’s deadline, or you won’t be able to get financial aid.

MYTH: The FAFSA is the only document you need to complete and deadline you need to meet to get financial aid.

FACT: The FAFSA helps you apply for federal, state, and school financial aid. It is not the only step, the FAFSA is the first step towards accessing aid – pay attention to requests for more information and make sure your documents are all accurate.

“Future Sacramento has provided me with the support necessary towards having a successful vision in life, and I am grateful for everything they have done. The rest is in my hands, and I plan to continue to achieve at the level Future Sacramento has prepared me for.” – Stephen